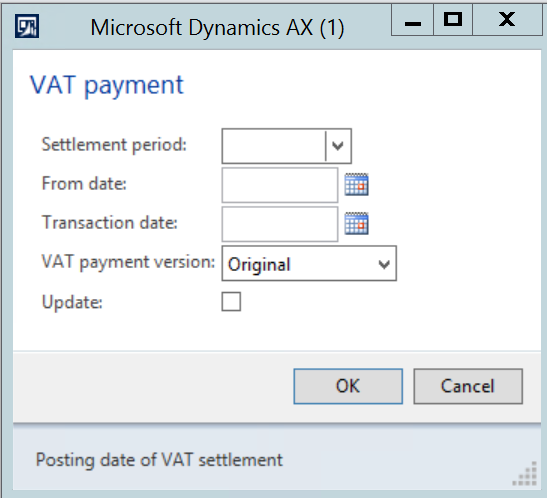

Step 1 - Run a VAT Payment report in AX

Within AX2012 R3

Go to General ledger, Periodic, VAT Payments, VAT Payments

Populate the following fields:-

- Settlement period

o Select the settlement period being reported

- From date

o Enter the date for the period being reported

- Transaction date

o Enter the posting date of the VAT return within AX

- VAT payment version

o Original – Displays the VAT totals prior to updating to the general ledger.

o Corrections – Displays the VAT totals of transactions posted after the update to the general ledger

o Latest corrections – Used to update the corrections to the general ledger

o Total list – Used to display the VAT totals to include the original entries and any correction entries

- Update

o If the update field is ticked then a journal will be posted to settle the VAT

o If the field is left unticked then no journal will be created

Example of VAT return print

Step 2 - To Export to csv

Once the VAT return has been validated and the values in the VAT return are correct then go to the Save icon and select the CSV menu option.

Save the file

Step 3 - Upload and submit the file to HMRC

Step 4 - Group VAT registration

Validate the VAT return with each AX company.

Repeat the above steps within each AX company to create the VAT return for that entity. Upload the VAT return for each AX company and the data will be summed together.

Step 5 - Update the VAT return in AX

Once the VAT return is submitted to HMRC then return to the VAT Payment report in AX.

Go to General ledger, Periodic, VAT Payments, VAT Payments

Select the same settings used to create the VAT return extracted for HMRC and select the Update field to post the journal within AX.